Credit risk workflow automation – a strategy for industries to bet on

Navigating the Challenges of Defaulters: A Bank’s Struggle

Imagine a bank that has been seeing a sharp rise in the number of defaulters. Despite thorough background checks and credit assessments, more customers are failing to meet their loan repayment obligations. The risk of these defaults is hitting the bank’s bottom line hard. The credit officers are overwhelmed, trying to manually assess the creditworthiness of each applicant, and it’s becoming increasingly difficult to keep up with the scale of requests.

This isn’t just an isolated problem. Businesses in multiple industries — from insurance and retail to fintech and real estate — face similar challenges. Whether it’s deciding whether to approve a loan, extend a credit line, or offer financing options, these industries are heavily reliant on accurate and efficient credit risk assessments. However, the manual process of reviewing financial data, creating risk models, and managing defaults is time-consuming and prone to human error. The result? Increased risks, inefficiencies, and missed opportunities.

The Credit Risk Assessment Challenge Across Industries

Credit risk is the risk of a borrower failing to meet their financial obligations as per the agreed-upon terms. Industries such as banking, insurance, retail, and fintech face constant pressure to ensure that they extend credit only to reliable customers. Here are some examples of how each sector deals with this challenge:

- Banks and Financial Services: Banks need to evaluate creditworthiness for various financial products like loans, mortgages, and credit cards. With many applications coming in daily, the process is tedious and prone to delays.

- Insurance: Insurers must assess the credit risk of policyholders and third-party providers to ensure they aren’t exposed to unmanageable financial risk. Automation can help assess premium rates based on creditworthiness quickly.

- Retail and E-Commerce: Retailers offering “buy now, pay later” options must quickly assess the risk associated with each customer. Manual processes lead to delays and missed opportunities.

- Fintech and Lending Platforms: Digital lenders also face the challenge of handling large volumes of loan applications. The faster they process applications, the better the customer experience, but manual processes slow this down.

- Telecom and Utilities: When offering installment plans or deferred payments, these companies need to evaluate customers’ ability to pay. A manual process makes it hard to assess vast amounts of customer data efficiently.

What is Credit Risk Assessment?

Credit risk assessment is the process by which an institution evaluates the likelihood that a borrower will default on their loan or credit obligations. A thorough credit risk assessment considers several factors, including:

- Credit Score: A numerical value that indicates the borrower’s creditworthiness.

- Income and Assets: The borrower’s financial stability and ability to repay the debt.

- Past Payment History: Historical data on how reliably the borrower has paid debts in the past.

- Industry/Market Conditions: The financial health of the industry in which the borrower operates.

- External Data: Economic trends, geopolitical risks, and other data that could influence a borrower’s financial situation.

Manual Credit Risk Assessment: The Traditional Process Flow

In many organizations, credit risk assessment is still largely a manual process. Here’s how this process typically unfolds:

[Data Collection] → [Risk Scoring] → [Creditworthiness Evaluation] → [Decisioning] → [Documentation] → [Ongoing Monitoring] → [Collections and Recovery]

Data Collection: Banks and other institutions gather data from multiple sources: credit bureaus, financial reports, bank statements, etc.

Risk Scoring: The credit officer manually assesses the data to assign a risk score to the borrower, using historical rules and industry standards.

Creditworthiness Evaluation: A credit officer evaluates the borrower’s creditworthiness based on risk scores, financial history, and market conditions.

Decisioning: The officer makes a decision about whether to approve or reject the loan or credit application.

Documentation: Necessary documentation is manually prepared and filed for record-keeping and compliance.

Ongoing Monitoring: After approval, credit officers monitor the borrower’s financial health and payment schedule manually.

Collections and Recovery (if necessary): If a borrower defaults, collection teams manually follow up with the borrower and manage recovery efforts.

The entire process is repetitive, time-consuming, and prone to errors, as each stage is dependent on human intervention. In a fast-paced, data-driven world, this is a serious challenge.

Where and How of Credit Risk Workflow Automation:

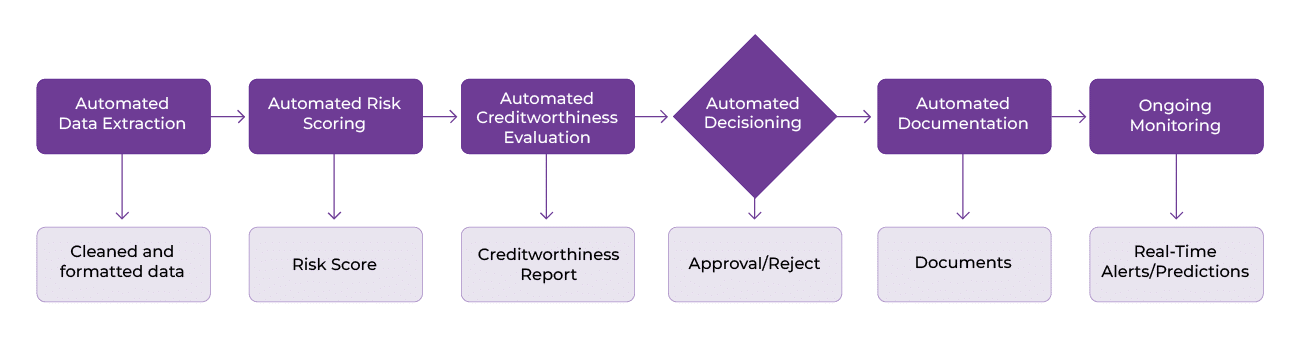

Now, let’s explore how automation can drastically improve each step of this workflow:

1. Data Collection:

In the traditional credit risk assessment process, gathering data is one of the most time-consuming and manual steps. Data needs to be collected from various external sources like credit bureaus, banks, financial records, and sometimes, even the borrower themselves. For instance, credit officers might request bank statements, tax returns, or employment history to evaluate a borrower’s financial situation. This manual collection can lead to delays, inconsistencies, and the potential for human error. However, with automation, this process becomes significantly more streamlined and efficient. Automation tools can instantly pull data from multiple internal and external sources, ensuring real-time, accurate, and complete information. These tools are integrated with various systems and platforms, enabling them to pull up-to-date data without any manual intervention. Moreover, machine learning models enhance data collection even further by handling unstructured data, such as customer emails or correspondence. They are trained to extract key information from these documents, improving the quality and depth of data available for decision-making. The result is a much more efficient process that saves time and improves the accuracy of the information used for credit risk analysis.

2. Risk Scoring:

Risk scoring is a critical step in the credit risk assessment process, as it helps determine the likelihood of a borrower defaulting on their obligations. Traditionally, credit officers would manually analyze the financial data available and assign a risk score based on predefined rules and criteria. However, this process can be subjective, inconsistent, and time-consuming. Automation, powered by machine learning algorithms, significantly improves this process. By utilizing historical data and vast datasets, machine learning models can instantly calculate a borrower’s risk score with much higher accuracy. These models can consider multiple parameters — such as income stability, credit history, outstanding debts, and even market trends — to generate a reliable risk score. Over time, as these models are exposed to more data, they continue to improve, adapting to emerging patterns and providing better risk predictions. The use of machine learning also ensures that risk scoring is done consistently, removing any biases that might come from manual assessments. The result is more accurate and real-time risk scoring, leading to better decision-making and risk management.

3. Creditworthiness Evaluation:

Evaluating a borrower’s creditworthiness is a vital step in determining whether to extend credit. Traditionally, credit officers would assess creditworthiness by analyzing static financial data, such as credit scores, income reports, and past payment history. However, this approach often overlooks important dynamic factors, such as market conditions, industry performance, or economic shifts. With the help of AI-powered tools, creditworthiness evaluation has become much more comprehensive and accurate. These tools use machine learning models to analyze historical trends and patterns, making predictions about a borrower’s future behavior. For example, they can assess the likelihood of a borrower defaulting on a loan by factoring in broader economic indicators, such as inflation rates or changes in the housing market. Additionally, these AI tools can process large datasets more efficiently than humans, enabling them to incorporate real-time information and external factors into the decision-making process. As a result, creditworthiness evaluations are much faster and more precise, providing a more holistic view of the borrower’s ability to repay the loan.

4. Decisioning:

Once the credit risk and creditworthiness have been assessed, the next step is decisioning — deciding whether to approve, reject, or modify the terms of a loan application. Traditionally, this process has involved a credit officer manually reviewing all available data and making a decision based on their judgment. While this process works for smaller loan volumes, it becomes inefficient and slow when dealing with large numbers of applications. Automation has transformed decisioning by enabling systems to make real-time decisions based on predefined criteria and risk thresholds. Automated decision-making engines use the data from the previous stages, such as the risk score and creditworthiness evaluation, to approve or reject loan applications instantly. These systems ensure consistency by following set business rules and minimizing human error. They can also adapt to different lending policies, such as offering different interest rates or repayment terms based on the applicant’s risk profile. This leads to faster processing times, enhanced customer satisfaction, and more accurate decision-making across the board.

5. Documentation:

Document preparation is another area where automation offers significant benefits. In the traditional manual process, once a loan is approved, the credit officer or lending team must prepare all the necessary documentation, including contracts, legal forms, and terms of the agreement. This can be a tedious and error-prone task, as even a small mistake in the documentation can lead to significant legal and financial issues. However, with automated document generation, the entire process becomes more efficient and accurate. Once the loan terms and approval are decided, automation tools can instantly generate all necessary documents, filling in pre-set information like the borrower’s name, loan amount, interest rates, and payment schedules. These tools can also ensure that documents are compliant with the relevant regulations and legal requirements. By reducing the manual effort required to generate these documents, businesses save time and reduce the risk of errors in critical paperwork.

6. Ongoing Monitoring:

After a loan has been approved and disbursed, ongoing monitoring is crucial to ensure that the borrower continues to meet their financial obligations. Traditionally, this monitoring has been a manual process, where credit officers regularly review the borrower’s payments, credit reports, and financial health. If payments are missed or there are signs of potential default, the bank must take immediate action to mitigate the risk. Automation tools can make this process much more efficient by continuously tracking borrower payments, updating financial health, and flagging late or missed payments. These systems can provide real-time alerts to credit officers or lending teams if a borrower’s creditworthiness changes or if they are at risk of default. Predictive analytics also play a key role in ongoing monitoring, as they can forecast future defaults based on a borrower’s behavior and other influencing factors. This enables the institution to take proactive steps, such as offering restructuring options or initiating collection processes before defaults occur, minimizing financial loss.

7. Collections and Recovery:

When a borrower defaults on a loan, collection and recovery become the focus of the lending institution. Traditionally, this process involves a lot of manual effort, as collection teams must follow up with defaulters through calls, emails, and letters. As the default period grows, the process can become more complicated, with escalating steps to recover the owed amount. Automation tools have revolutionized collections and recovery by streamlining and accelerating these processes. Automated collection systems can send reminders and notifications to borrowers who are late on their payments, and even escalate the issue to the appropriate teams if the situation worsens. These systems can follow up on missed payments at predefined intervals, ensuring that no debtor is overlooked. Additionally, automation can extend to the recovery process, with automated tools sending legal notices or initiating payment restructuring procedures. By automating these steps, businesses can recover debts more efficiently, reduce the time spent on manual collections, and improve the overall recovery rate.

Illustration of Credit Risk workflow automation:

Conclusion

Conclusion

Credit risk assessment is a complex, yet crucial process for businesses across multiple industries. While manual processes have served their purpose, they are slow, prone to human error, and increasingly inefficient in a data-driven world. By adopting Credit risk workflow automation — from data collection and scoring to decisioning and collections — organizations can enhance efficiency, reduce costs, and minimize the risk of defaults.

For industries ranging from banking to retail, automation offers a clear path toward better, faster, and more reliable credit srisk management. By embracing automation, businesses can navigate the challenges of the modern financial landscape, ensuring that they can make smarter, data-driven decisions while mitigating risk more effectively. Talk to our experts to learn more.