Automated loan underwriting and AI-based loan approvals

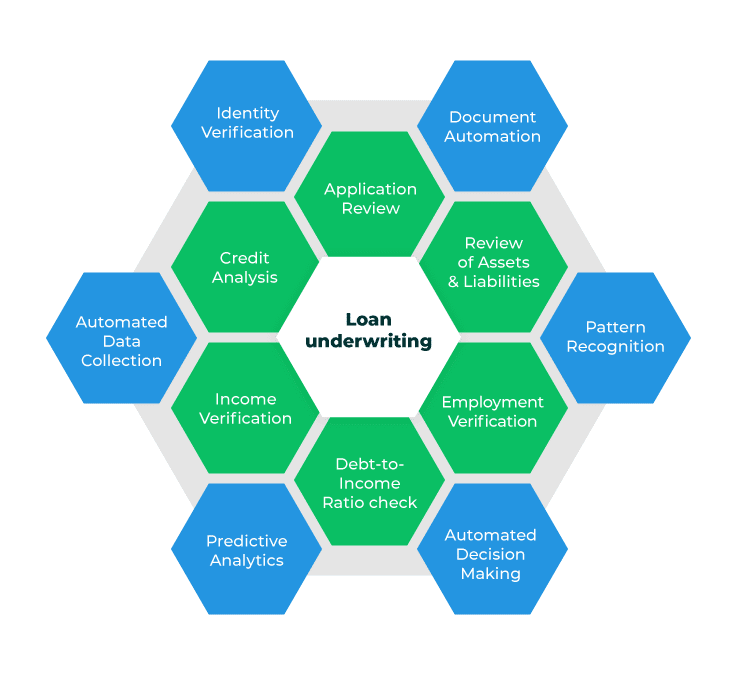

Ascertaining that the borrower is capable of fulfilling their repayment obligations is necessary for a lender to ensure that the loan is a sound investment. Financial services undertake a detailed Loan underwriting process to achieve the same. In Loan underwriting process, lenders evaluate the risk of issuing a loan to a borrower. It involves assessing the borrower’s creditworthiness and the likelihood that they will be able to repay the loan. The lender reviews the borrower’s loan application, including the information provided about income, employment, and other financial details and checks the borrower’s credit history and credit score to determine their creditworthiness. A higher credit score generally indicates a lower risk of default. The lender also verifies the borrower’s income by examining pay stubs, tax returns, and other documentation to ensure they have a steady and sufficient income to repay the loan. The lender also calculates the borrower’s debt-to-income ratio (DTI) to assess their ability to manage monthly payments and repay the loan. A lower DTI indicates better financial stability. Then they verify the borrower’s employment status and stability, often by contacting the employer or reviewing employment documentation and examines the borrower’s assets (such as savings, investments) and liabilities (such as other loans) to get a complete picture of their financial situation. For secured loans, such as mortgages, the lender conducts an appraisal of the property to ensure its value is sufficient to cover the loan amount in case of default.

Effective underwriting contributes to the overall financial stability of the banking institution. Underwriting helps banks and financial institutions manage risk by thoroughly evaluating the creditworthiness of borrowers. By assessing the likelihood of default, lenders can make informed decisions and minimize the risk of financial loss. Underwriting also ensures compliance with regulations, helping institutions avoid legal and financial penalties. By doing diligent loan underwriting process, banks are able to maintain high credit quality is essential for the reputation and operational success of financial institutions.

In this blog, we are trying to see how AI and automation helps financial institution in an efficient and thorough loan underwriting process. Automated loan underwriting and AI-based loan approvals are rapidly gaining traction as financial services increasingly adopt advanced technologies to stay competitive. These innovations streamline the loan approval process, enhance accuracy, and reduce the time required to assess risk and approve loans. As a result, financial institutions can offer more personalized and efficient services to their customers, driving growth and customer satisfaction.

Identity verification

Identity verification

Advanced biometric technologies, such as facial recognition and fingerprint scanning is used to ensure that the borrower’s identity is accurate and secure. It automates the verification process by instantly cross-referencing data with multiple sources, reducing the time and effort required for manual checks. This not only speeds up the loan approval process but also increases accuracy by detecting patterns and anomalies indicative of fraud. Additionally, AI-driven verification helps maintain regulatory compliance by ensuring that all identity verification procedures meet legal standards, thus reducing the risk of identity theft and fraud.

Data Collection

Automated data collection transforms the loan underwriting process by swiftly gathering and integrating borrower information from multiple sources, including credit bureaus, bank statements, tax returns, and public records. This automation utilizes APIs and advanced algorithms to retrieve real-time data, eliminating the need for manual data gathering, which is both time-consuming and prone to errors. By ensuring comprehensive and up-to-date information, automated data collection enhances the accuracy of risk assessments and speeds up the decision-making process. It also facilitates more consistent and objective evaluations by standardizing the data collection process, thereby reducing biases, and improving overall efficiency. This leads to faster loan approvals, better customer satisfaction, and a more streamlined workflow for underwriters.

Document Automation

AI-enabled document automation significantly streamlines the loan underwriting process by automatically extracting, validating, and organizing data from various documents such as tax returns, bank statements, and pay stubs. This technology uses Optical Character Recognition (OCR) and Natural Language Processing (NLP) to accurately read and interpret information, reducing the need for manual data entry and minimizing errors. By automating these tasks, AI ensures faster and more efficient processing of loan applications, allowing underwriters to focus on more complex decision-making aspects. Additionally, AI can cross-verify the extracted data against multiple sources to detect discrepancies and potential fraud, enhancing the reliability and security of the underwriting process. This automation not only speeds up the approval process but also improves accuracy and compliance, ultimately leading to a better customer experience and more robust risk management.

Predictive analytics

Predictive analytics revolutionizes the loan underwriting process by utilizing historical data and advanced algorithms to forecast the likelihood of a borrower’s default. By analyzing various factors such as credit history, income patterns, employment stability, and spending behaviors, predictive models can provide a more accurate risk assessment. These analytics help underwriters identify potential red flags and determine the probability of repayment, allowing for more informed lending decisions. Furthermore, predictive analytics can segment borrowers into different risk categories, enabling lenders to tailor loan terms and interest rates appropriately. This approach not only enhances the efficiency and accuracy of the underwriting process but also reduces the risk of defaults, improves loan portfolio performance, and ultimately leads to more personalized and fair lending practices.

Pattern Recognition

Pattern recognition enhances the loan underwriting process by identifying and analyzing patterns in borrower data to detect anomalies, trends, and potential risks. Utilizing machine learning algorithms, pattern recognition systems can sift through vast amounts of data, such as transaction histories, spending behaviors, and credit usage, to uncover hidden correlations that might indicate a borrower’s creditworthiness or risk of default. For example, consistent late payments or sudden changes in income patterns can be flagged as risk indicators. This automated analysis allows for more accurate and timely decision-making, as underwriters can quickly identify high-risk applications and take appropriate actions. By providing deeper insights into borrower behavior, pattern recognition not only improves the precision of risk assessments but also helps in creating more personalized loan offers, enhancing overall efficiency, and reducing the likelihood of financial loss.

Automated decision-making

Automated decision-making significantly enhances the loan underwriting process by leveraging advanced algorithms and machine learning models to make quick, consistent, and accurate lending decisions. By automating routine tasks such as evaluating credit scores, verifying income, and assessing risk factors, these systems can process loan applications much faster than traditional methods. This not only reduces the turnaround time for loan approvals, leading to a better customer experience, but also ensures consistency in decision-making by eliminating human biases and errors. Automated decision-making systems can continuously learn and adapt to new data, improving their accuracy over time. This leads to more reliable risk assessments, optimized loan portfolios, and ultimately, a more efficient and scalable underwriting process that can handle higher volumes of applications without compromising on quality.

AI and automation have transformed the loan underwriting process by significantly enhancing speed, accuracy, and efficiency. These technologies automate data collection and integration, enabling real-time processing and reducing the need for manual input. Predictive analytics and pattern recognition improve risk assessment by analyzing vast amounts of data to identify potential risks and opportunities, leading to more informed lending decisions. Automated decision-making ensures consistent and unbiased evaluations, speeding up loan approvals and enhancing customer satisfaction. Additionally, AI-driven identity verification and document automation enhance security and compliance, reducing fraud and errors. Overall, AI and automation streamline the underwriting process, resulting in faster, more accurate, and scalable loan approvals that benefit both lenders and borrowers.

Talk to our experts to know more.